Bond duration formula

The idea is that bond prices and. In the example shown we want to calculate the duration of a bond with an annual coupon rate of 5.

Covalent Bond Covalent Bonding Chemical Bond Water Molecule

The formula for Modified Duration can be calculated by using the following steps.

. Here is a summary of all the components that can be used to calculate Macaulay duration. Excel also provides the MDURATION function for calculating modified duration. Duration is defined as the weighted average of the present value.

Frac Macaulay Duration 1frac YTM Annual Payments 1 Annual P aymentsY TM M acaulay Duration. FV par value C coupon payment per period half-year i discount rate per period half-year a fraction of a period remaining until next coupon payment. Bond price is 9637.

Macaulay Duration 607934 1000 607934. The formula used to calculate a bonds modified duration is the Macaulay duration of the bond divided by 1 plus the bonds yield to maturity divided by the number of coupon. For a standard bond with fixed semi-annual payments the bond duration closed-form formula is.

Annual coupon rate is 6. Bond face value is 1000. Macaulay Duration Formula Example 1.

You can refer given excel. The formula to calculate the percentage change in the price of the bond is the change in yield multiplied by the negative value of the modified duration multiplied by 100. Current Bond Price PV of all the cash flows 607934.

A bond duration calculator is used for a purpose that communicates the value change in the worth of security because of an adjustment of financing costs. Go Direct And Save With A-Rated Insurers. Firstly determine the YTM of the security based on its current market price.

Based on the above information here are all the components needed in order to. Calculation of Macaulay Duration will be. The percentage change of the bond price equals -1 times modified duration times yield change.

The modified duration formula is. Get Your Free Quotes Online Today. Bond A has a Coupon of 7 and a Yield of 6.

Therefore for our example m 2. Let us take the example of two bonds A and B with a similar face value of 100 and a frequency of 2. Now we will upgrade the formula and add the convexity adjustment to it.

The DURATION function one of the Financial functions returns the Macauley duration for an assumed par value of 100. M Number of payments per period 2. Ad Get Your Free No Obligation Bond Quote in Under Two Minutes.

Taxable Corporate Bonds Vs Municipal Bonds Tax Exempt Non Taxable After Tax Equivalent Formula Corporate Bonds Bond Corporate

Pin On Structure And Bonding In Organic Chemistry

Pin On Compunds

Quantum Mechanics 12c Dirac Equation Iii Quantum Mechanics Dirac Equation Quantum

Steric Number And Bond Angles Teaching Chemistry Molecular Geometry Chemistry

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

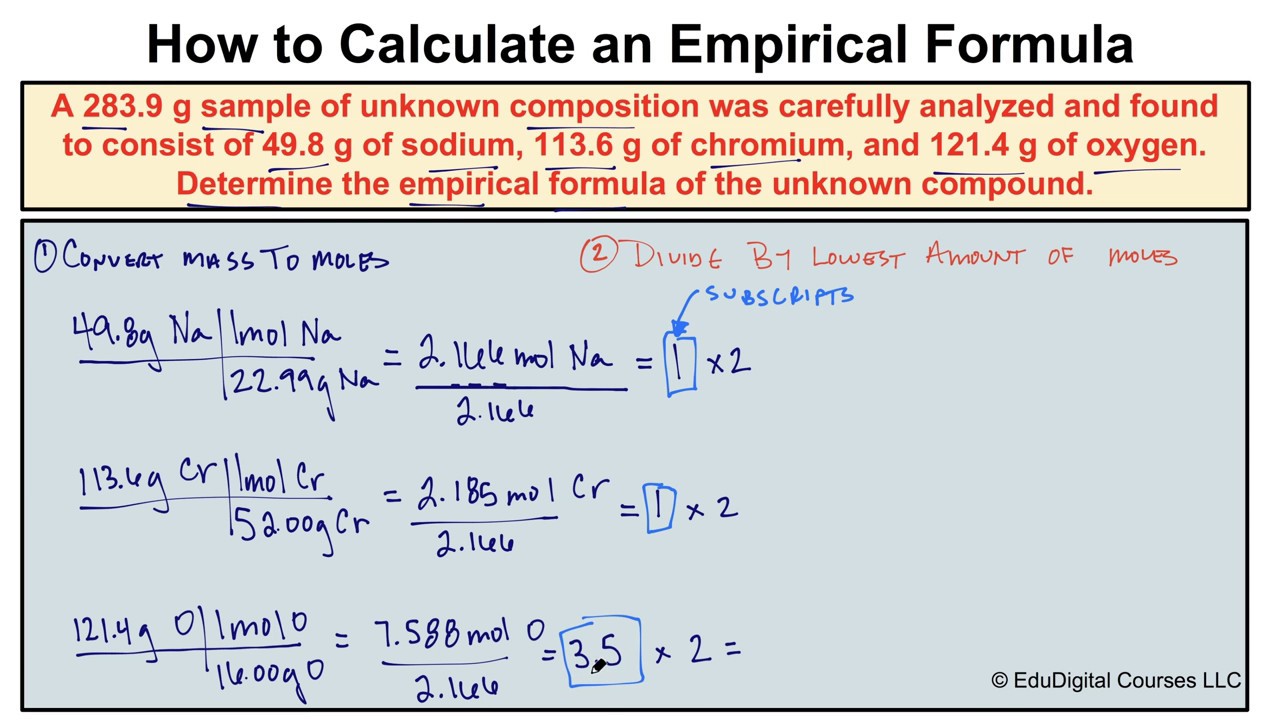

How To Calculate An Empirical Formula Chemistry Worksheets Chemistry Notes Scientific Method Worksheet

Partial Pressures Of Gases And Mole Fractions Chemistry Tutorial Mole Fraction Chemistry Fractions

Types Of Organic Chemistry Formula Poster By Compound Interest Organic Chemistry Study Chemistry Basics Chemistry Lessons

Chemsolve Net Physical Chemistry Molecular Organic Chemistry

Compound Interest Organic Chemistry Study Chemistry Basics Chemistry Lessons

What Is A Product In Chemistry Definition And Examples Chemistry Definition Chemistry What Is A Product

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

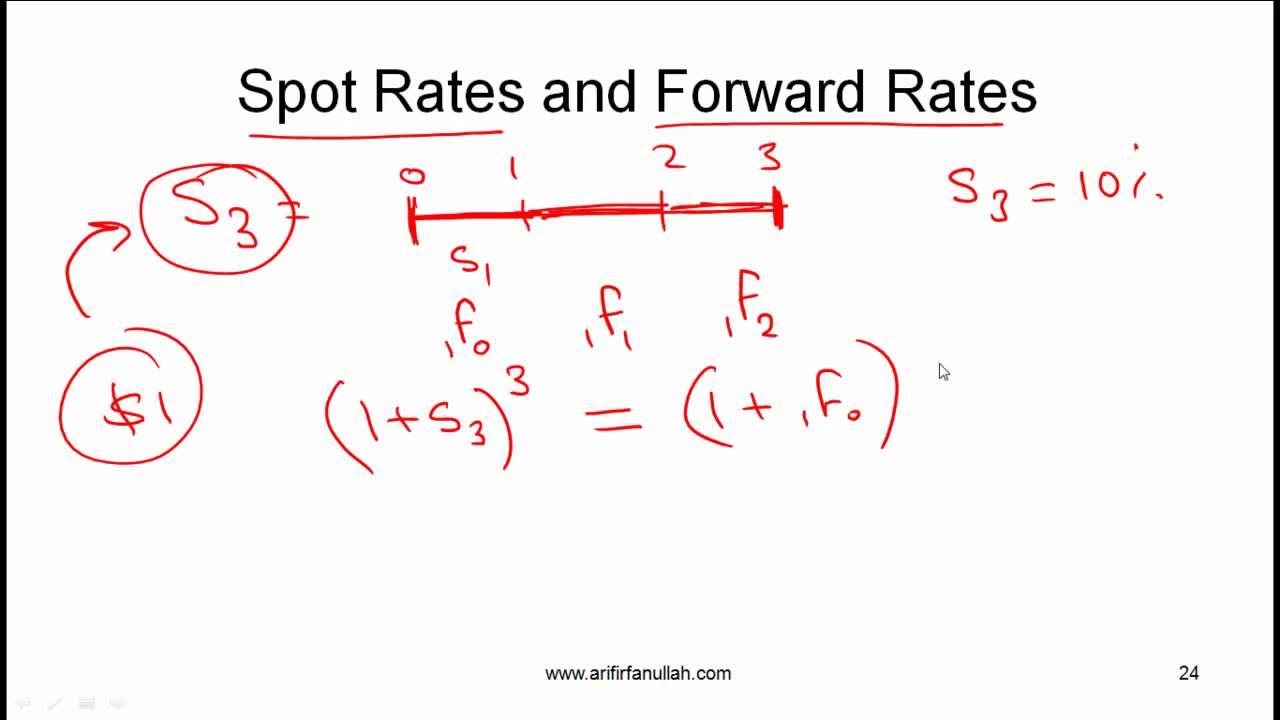

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Nocl Lewis Structure Nitrosyl Chloride Math Lewis Molecules

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Degrees Of Unsaturation Or Ihd Index Of Hydrogen Deficiency Chemistry Index Organic Chemistry